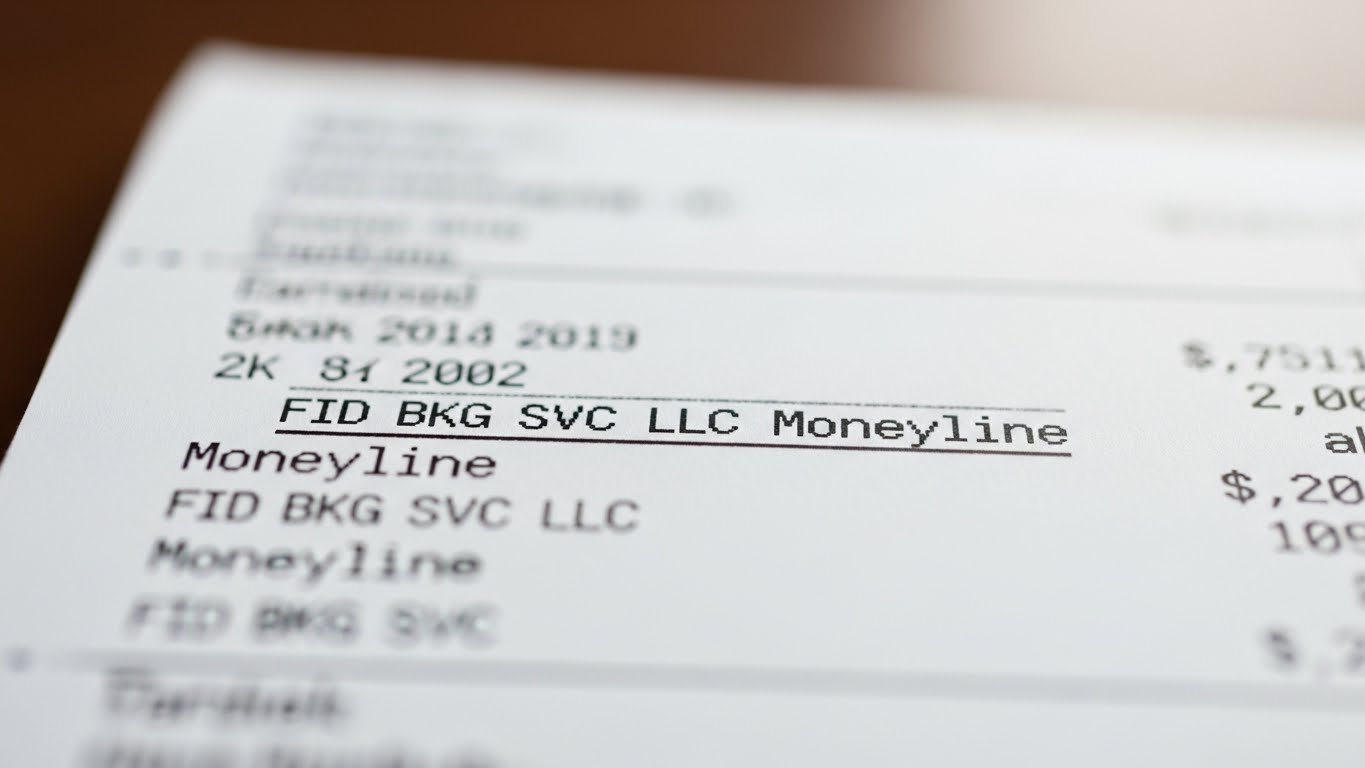

Have you ever glanced at your bank statement and stumbled upon a charge that left you scratching your head? If you’ve noticed FID BKG SVC LLC Moneyline appearing on your transaction list, you’re not alone. Many people have questions about what this entry means and why it’s there. Understanding the nuances of our financial statements is crucial in today’s world, especially as digital transactions become more common. Let’s unravel the mystery behind FID BKG SVC LLC Moneyline so you can confidently navigate your finances without fear or confusion.

Understanding Bank Statements and Transactions

Bank statements serve as a detailed record of your financial activities over a specific period. They list all transactions, including deposits, withdrawals, and fees. Each entry provides insights into your spending habits.

Understanding these documents is essential for effective budgeting. You can spot trends in your expenses or identify areas where you might be overspending. Familiarizing yourself with the format helps you quickly recognize unfamiliar charges.

Transactions on bank statements typically include the date, description, and amount involved. This information allows you to track where your money goes each month.

By regularly reviewing your bank statements, you’re better equipped to manage finances proactively. It also sharpens your ability to detect discrepancies or unauthorized charges that may require further investigation.

What is FID BKG SVC LLC Moneyline?

FID BKG SVC LLC Moneyline refers to a specific transaction descriptor that may appear on your bank statement. This label is associated with financial services provided by FID BKG SVC, which stands for Fidelity Banking Services.

Typically, these transactions relate to money management services or online gambling platforms. The “Moneyline” component often indicates the nature of the service or transaction type, commonly linked to betting activities.

If you see this entry on your statement, it could signify various services ranging from deposits and withdrawals to fees related to those transactions. Understanding its origin can help clarify any confusion surrounding unexpected charges.

It’s essential to recognize that not all entries labeled under FID BKG SVC LLC are fraudulent. Many users engage legitimately with these financial services without issues.

Possible Reasons for Seeing FID BKG SVC LLC Moneyline on Your Bank Statement

Seeing FID BKG SVC LLC Moneyline on your bank statement can be puzzling. This entry usually indicates a transaction related to banking services or financial products.

One common reason is a payment for an online subscription or service you signed up for. Many companies use this name for billing purposes, making it essential to track your subscriptions actively.

Another possibility is that it’s associated with a loan or credit service you engaged with recently. If you’ve applied for any form of financing, the charge may stem from that process.

Sometimes, promotional offers linked to financial institutions might also appear under this label. These transactions could relate to cash advances or special deals provided by banks.

In rare cases, it might signal fraudulent activity. Always verify if the transaction aligns with your known expenses before taking further steps.

How to Confirm the Transaction

To confirm a transaction labeled as FID BKG SVC LLC Moneyline, start by checking your recent purchase history. Look for any known payments you may have made through this service.

Next, log into your online banking account. Review the transaction details carefully, including the date and amount charged. This can provide clarity on whether it aligns with any purchases you’ve authorized.

If you’re still unsure, reach out to customer support at your bank. They can offer additional insights into the charge and help clarify its origin.

Additionally, consider searching for “FID BKG SVC LLC” online to see if others report similar transactions. This could shed light on common usage or issues related to this particular entry on your statement.

Taking these steps ensures that you’re well-informed about where your money is going and helps in managing your finances more effectively.

Tips for Protecting Yourself Against Fraudulent Charges

Staying vigilant is key to protecting your finances. Regularly monitor your bank statements for any unfamiliar transactions, including FID BKG SVC LLC Moneyline.

Set up alerts through your bank’s app or website. This way, you can receive notifications about account activity in real time.

Use strong and unique passwords for online banking. Consider enabling two-factor authentication for an extra layer of security.

Be cautious with sharing personal information. Only provide sensitive data on secure websites that you trust.

If possible, utilize virtual cards when shopping online to limit exposure. These temporary card numbers can help safeguard against unauthorized charges.

Familiarize yourself with common signs of fraud so you can act quickly if something feels off. Keeping informed is one of the best defenses against financial scams.

Conclusion

Seeing FID BKG SVC LLC Moneyline on your bank statement can initially be confusing, but in most cases, it’s tied to a legitimate financial or banking-related transaction. By understanding how bank statements work and recognizing common reasons behind this entry, you can avoid unnecessary worry and stay in control of your finances. Regularly reviewing your statements, confirming unfamiliar charges, and taking proactive steps to protect against fraud will help ensure your accounts remain secure. When in doubt, contacting your bank or the service provider is always the best way to gain clarity and peace of mind.